Q3 2025 Market Commentary

Matthew Mobilio | CFA, CFP® | Portfolio Manager at Louisbourg Investments

As we move into the final quarter of 2025, investors are navigating a landscape defined by both opportunity and transition. With recent rate cuts from the Bank of Canada and the U.S. Federal Reserve signalling a turning point in monetary policy, it’s an important time to take stock of where markets stand — and where they may be headed next. I encourage you to read the latest Quarter 3 Market Update from Matt Mobilio, Portfolio Manager at Louisbourg Investments. Matt provides thoughtful insights on the shifting economic environment, market concentration risks, and the importance of maintaining balance and liquidity in portfolio construction. His commentary offers perspective on how disciplined, diversified strategies can help investors stay on course amid changing conditions.

Quarter 3 Market Update

This quarter marked a key turning point as both the Bank of Canada and the U.S. Federal Reserve began easing monetary policy. The BoC cut its overnight rate by 25 basis points to 2.50%, citing softer inflation and slower economic momentum. The Fed reduced its federal funds rate by 25 basis points to a range of 4.00%–4.25%, reflecting cooling growth and continued progress on inflation. As we move through the latter part of 2025, we’re starting to see some clear signs of strain emerging in both the Canadian and U.S. economies.

This year’s Whistler GranFondo finally happened, and like the economy, it was a true test of endurance. After months of training and planning, the day itself brought a mix of smooth stretches and steep, grinding climbs. Much like the ride, the economic path this year has been anything but linear. The first half felt manageable, supported by steady growth and resilient employment, but now we’re starting to hit the steeper sections, higher delinquencies, a softening housing market, and signs of fatigue across both Canada and the U.S. The lesson from the Fondo applies just as well to investing: the hard climbs are where discipline and preparation matter most. Staying diversified, maintaining liquidity, and avoiding overconfidence, particularly in less liquid assets like private real estate or private equity, are what allow us to keep momentum and reach the finish line in good form.

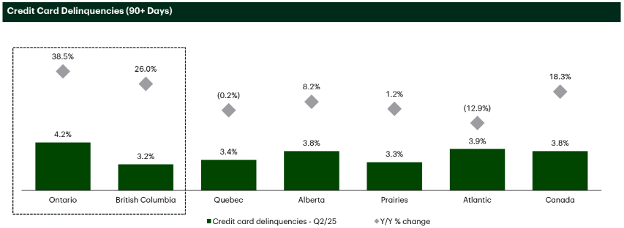

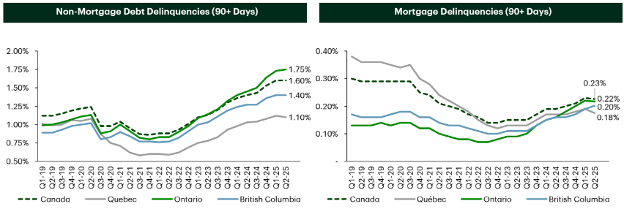

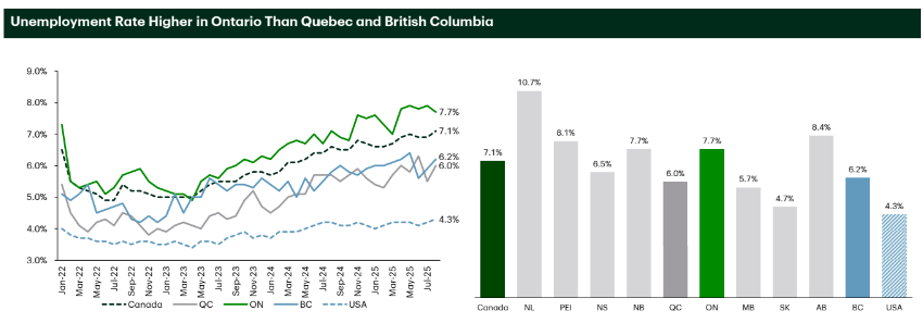

In Canada, cracks are forming beneath the surface. Recent data shows delinquencies are on the rise, particularly in consumer credit (Image 1) illustrates the year-over-year increase in credit card delinquencies by province, as well as the national trend and non-mortgage and mortgage segments (Image#2) highlights the pace of delinquencies across various non-mortgage credit types, including auto loans, credit cards, and personal lines of credit. According to TD’s latest report, the labour market has softened (Image#3), and we’re now seeing weakness across the housing market, most notably in Ontario but increasingly nationwide. After years of resilience, high borrowing costs and slower job growth are beginning to weigh on household finances and consumer spending.

* Image#1

Source: Equifax, TD Cowen

* Image#2

Source: Equifax, TD Cowen, Canadians Banker Association

* Image #3

Source: Statistics Canada, St. Louis FRED, TD Cowen

In the U.S., economic momentum has held up better, but signs of fatigue are appearing as well. The lagged effects of tighter monetary policy and elevated real rates are now filtering through to growth and employment. While inflation has eased meaningfully, the path forward still depends heavily on how the labour market evolves and how long policy remains restrictive.

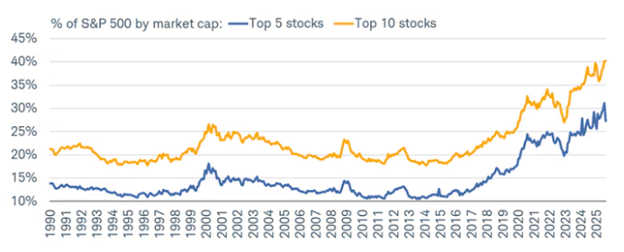

Now, the largest 10 companies in the S&P 500 now account for roughly 40% of the index’s total market capitalization, with the top five alone representing about 27%, levels that far exceed the concentration seen at the height of the dot-com era in 2000. Such a high degree of concentration can create both risks and opportunities for investors, as market performance becomes increasingly driven by a handful of mega-cap names. At Louisburg, we remain committed to our disciplined investment process and take pride in maintaining a differentiated approach that avoids excessive concentration. This philosophy provides meaningful diversification benefits and helps position portfolios for more balanced, sustainable returns over time.

*Source: Bloomberg, FactSet, Federal Reserve, Standard & Poor's, Strategas/Ibbotson, J.P. Morgan Asset Management.

A small group of large companies now makes up an unusually high share of the S&P 500’s total value and returns. This concentration means market performance is being driven by just a few dominant names, while many other stocks are lagging behind. As a result, index gains may give a misleading picture of overall market strength. For investors, this creates a risk that portfolios linked to cap-weighted indexes become more exposed to company- or sector-specific downturns, weakening the diversification those indexes are meant to provide.

As the economies slowing it might be a good time to look at another theme this quarter is liquidity risk, or, more precisely, illiquidity. Alternative investments have become a center of topic over the years for retail clients, albeit institutions who have a perpetual timeline have been employing these strategies for a long time. The Alternative investments we see most are real estate funds and private equity funds. They can play an important role in diversification and long-term return potential. However, when these assets become too large a portion of a portfolio, they can introduce hidden risks. What are these risks?

Because they are not priced daily, these types of investments tend to “smooth” returns, making them appear more stable than they really are. This “smoothing effect” can understate volatility (risk) and overstate returns, leading investors to believe their risk exposure is lower than it truly is. While a modest allocation to alternatives can provide valuable diversification benefits, overexposure can become problematic when liquidity is needed most; especially in periods of market stress when access to capital is limited or redemption gates are triggered.

In closing, balance and diversification remain critical. Being selective, and mindful of liquidity will continue to be an important part of portfolio management. Hear what our head portfolio managers are doing at Louisburg Investment with the ever-changing landscape. Our head portfolio managers discuss their market Market Commentary - Q3 2025 - Louisbourg Investments.

Author:

Matthew Mobilio, CFA, CFP

Louisbourg Investments Inc., Portfolio Manager

As always, for more information about Ciccone-McKay Financial Group, or if you want to chat with someone at the firm, we welcome your call: 604-688-5262.